11月15日,加拿大保险局IBC发布了“自动驾驶汽车保险:为未来交通方式做准备”的报告。预计未来几年内动驾驶车辆将出现在加拿大境内的道路上。几家自动驾驶车辆厂商预计最早在2020年将出售自动驾驶车辆。自动驾驶车辆将革命性地改革人员和货物运输方式。

报告提出三项建议:一是建立既能覆盖司机误操作,又能包括自动化技术故障的单一保险单,从而使责任索赔更容易;二是实现车辆制造商、车主和保险公司之间的数据共享,以便确定事故原因;三是建议联邦车辆在考虑到新技术应用的前提下更新安全标准和网络安全标准。

根据加拿大汽车协会的发言人Ian Jack的说法,尽管IBC希望推动这份报告的落实,但完全自动驾驶的实现还有很长的路要走。

以下为报告原文:

----------------------------------------------------------------------------------------------

Introduction

In the coming years, vehicles with fully automated capabilities will be on Canada’s roads. Several vehicle manufacturers expect to have automated vehicles available for purchase in the early 2020s. These vehicles will revolutionize the way people and goods travel.

Canadians spend at least 5 billion hours per year driving,1 resulting in approximately 2,000 fatalities and more than 160,000 injuries annually.2 Automated vehicles could change this trend.

They could make the roads safer, enhance mobility, and reduce traffic congestion and emissions. According to the Conference Board of Canada, Canadians could save $65 billion annually, including $37.4 billion in collision costs, $20 billion in time, $2.6 billion in fuel and $5 billion from less congestion.

Since these benefits align with public policy objectives, governments around the world are embracing automated vehicles. In Canada, all levels of government and the private sector are examining this technology from the perspectives of economic development, mobility, road safety and the environment.

While there is potential for public good, there are also risks, particularly if an automated vehicle is in a collision. Governments and insurance regulators have a responsibility to manage these risks to ensure that public safety is maintained and, when collisions occur, those who are injured get compensated fairly and quickly.

Anticipated Rollout of Automated Vehicles

Automated vehicles are equipped with technologies that facilitate or control driving systems without direct input from the human driver. The U.S. Department of Transportation’s National Highway Traffic Safety Administration defines fully automated vehicles as follows:

Those in which operation of the vehicle occurs without direct driver input to control the steering, acceleration, and braking and are designed so that the driver is not expected to constantly monitor the roadway while operating in self-driving mode.

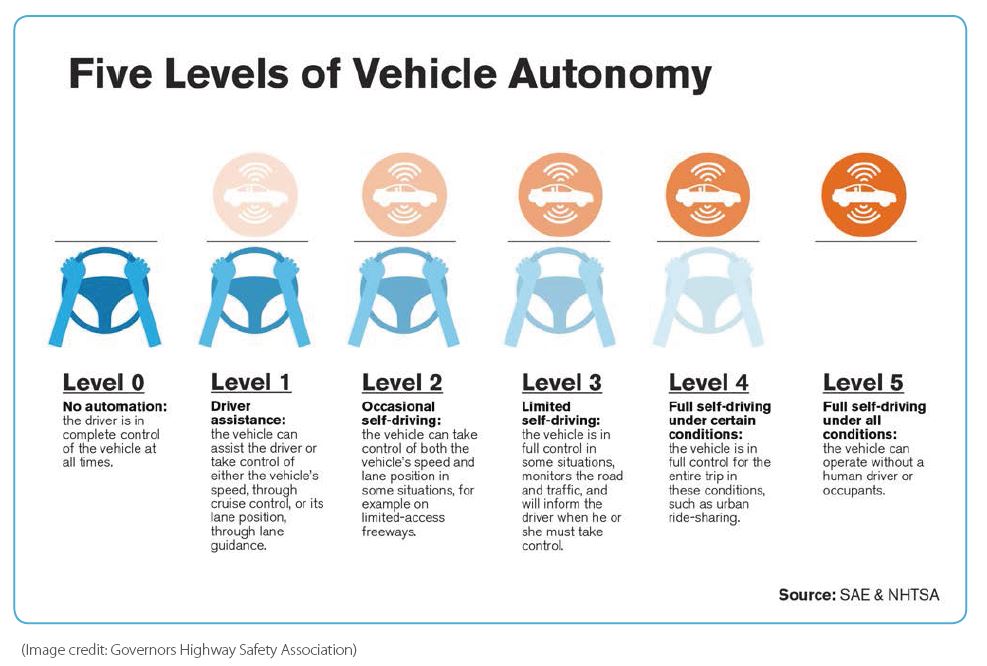

The Society of Automotive Engineers (SAE) developed levels of assistance and automation for vehicles. There are five levels, ranging from driver assistance to full automation.

Vehicle manufacturers and technology providers are racing to participate in the automated vehicle market. Nissan expects to introduce automated vehicles in the 2020s. Volvo partnered with Uber to bring them to market by 2021. Ford expects to have vehicles that can operate without human interaction and without steering wheels or gas or brake pedals by 2021.

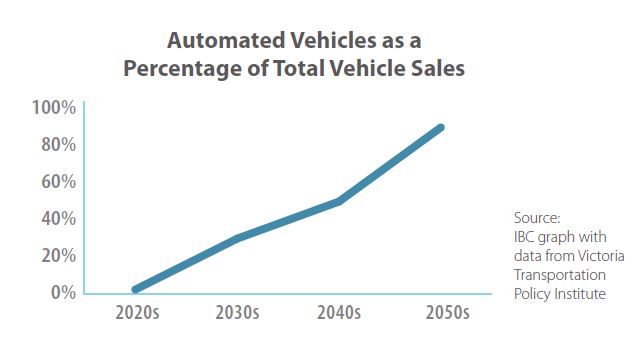

Despite these plans, it could take years before automated vehicles are widely used. People and businesses will have to replace their existing vehicles and automated vehicles will have to become more affordable. The Victoria Transportation Policy Institute predicts that only by the 2040s will automated vehicles make up half of new vehicle sales.

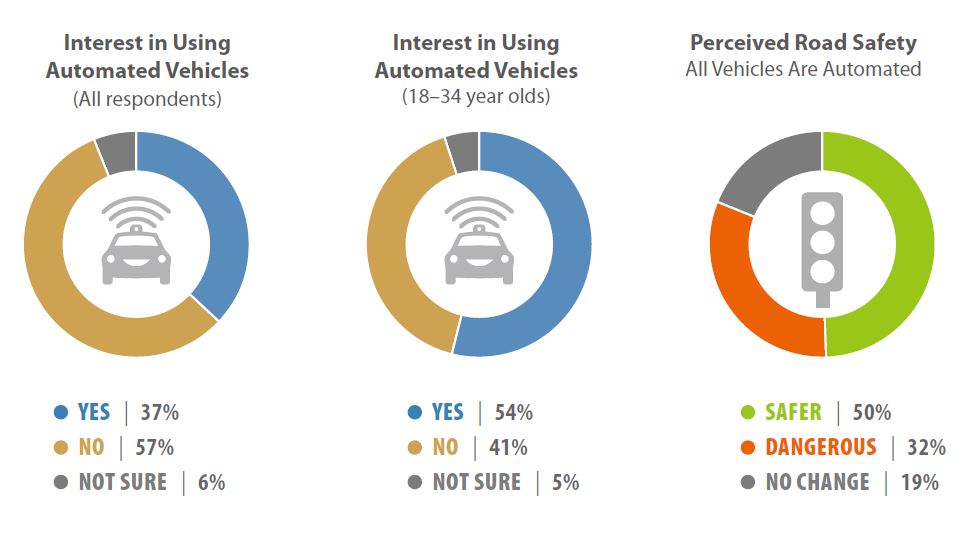

IBC recently conducted a national survey whose results suggest that despite consumer skepticism regarding automated vehicles, the technology has significant potential. Only 37% of Canadians state that they are interested in using an automated vehicle. However, 54% of millennials state that they are interested in using these vehicles when they come to market. Also, 50% of Canadians agree that road safety will improve once all vehicles are automated.Regardless of what may initially be slow take-up, there is no doubt that some Canadians and businesses will be using automated vehicles in the near future.

Canadian Auto Insurance

In Alberta, Ontario and Atlantic Canada, where private sector insurers offer auto insurance, the auto insurance policies prescribed in provincial laws are designed to ensure that people injured in collisions are compensated fairly and quickly. Fair and quick compensation is achieved through a combination of compensation from a person’s own insurer and, if applicable, a tort or liability claim against the driver responsible for the collision. In these provinces, drivers have to obtain the following auto insurance coverage for injuries:

Accident benefits (except in Newfoundland and Labrador);

and Third-party liability coverage.

Accident benefits pay for treatment, care and income replacement to help the injured person recover. They are also known as “no-fault benefits” because the person’s own insurer pays them regardless of who caused the collision.

Third-party liability coverage protects a person from the cost of any injuries that he or she caused to another person in a collision. The person who did not cause the collision has the right to sue the person responsible for anything not covered by accident benefits.

The Changing Insurance Landscape

IBC anticipates that the rollout of automated vehicles will affect all auto insurance policies and supporting legislation in four ways.

There will be fewer collisions, but the technology in automated vehicles will make repair and replacement more expensive: In a U.S. study, KPMG predicts that over the next 10 years, automated technologies will reduce the frequency of collisions by 35% to 40%. However, because the technology for automated vehicles is expensive, KPMG predicts that repair costs will increase by 25% to 30%.

Vehicle use will have new risks: The European Parliamentary Research Service identified risks that will emerge with the rollout of automated vehicles. These risks include software and network failure, programming choices, hacking and cybercrime, and failure to install or update software.

Vehicles will record significant amounts of data: Vehicles will be equipped with complex sensors that can monitor and record vehicle activity. According to Deloitte, this data will be more reliable than human-reported or human-collected information for assessing risk, pricing auto insurance, managing claims and detecting fraud.

Responsibility for collisions will shift from the driver to the automated technology: The U.S. National Highway Traffic Safety Administration states that human error is the primary cause of more than 90% of collisions. As automated vehicles shift liability toward vehicle manufacturers and technology providers, there will be more product liability litigation.

Insurance Models for Automated Vehicles

The shift in responsibility for collisions from the driver to the automated technology will be challenging as Canada’s auto insurance policies and supporting legislation are built on the notion that human error is the primary cause of collisions. Potential approaches for addressing the shift in responsibility include the following:

Maintain the status quo;

Establish full no-fault insurance; and

Cover both driver negligence and the automated technology under a single insurance policy.

1.Status Quo

In the 2014 U.S. study Products Liability and Driverless Cars: Issues and Guiding Principles for Legislation, the Brookings Institute states that resolving potential liability issues should not be a precondition to the rollout of automated vehicles.

Products liability law has proven to be remarkably adaptive to new technologies. The same will hold true for autonomous vehicle technologies. Products liability has been one of the most dynamic fields of law since the middle of the 20th century. Given this strong record of adaptation to new technologies, there is no reason to expect that the legal system will be unable to address the products liability issues that arise with respect to autonomous vehicles.

In Canada, product liability litigation is more complex and can take several years longer to resolve than the two to four years associated with the average vehicle collision claim. In the transitional period when conventional, assisted-driving and fully automated vehicles share the roads, determining who is liable for a collision will be especially complicated and protracted.

People injured in collisions involving automated vehicles will be able to receive some treatment, care and income replacement the way injured people receive them now. But, because of product liability litigation, those people with a liability claim will have to wait longer to be compensated. Depending on the length of the litigation, an injured person could use up the available treatment, care and income replacement years before finalizing the liability claim. If the public policy objective governing auto insurance is ensuring that injured people get compensated fairly and quickly, relying on product liability law to adapt and simplify is risky.

2. Full No-fault Insurance

In the 2016 study Autonomous Vehicle Technology: A Guide for Policymakers, the RAND Corporation recommends no-fault insurance where injured people receive treatment, care and income replacement from their own insurer and do not have the right to pursue a liability claim.

This shift in responsibility from the driver to the manufacturer may make no-fault automobile-insurance regimes more attractive. While the victims in these circumstances could presumably sue the vehicle manufacturer, product-liability lawsuits are more expensive to bring and typically take more time to resolve than run-of-the-mill automobile-crash litigation. No-fault systems are designed to provide compensation to victims relatively quickly, and they do not depend upon the identification of an “at-fault” party.

The RAND Corporation’s recommendation applies to a scenario when most vehicles on the roads are fully automated.

No-fault insurance for automated vehicles cannot co-exist with the mixed no-fault and tort policies that are common in Canada. Although no-fault insurance may be the best approach in an environment where most vehicles are automated, having all provinces transition to no-fault insurance in the near future, when automated vehicles are only starting to be available for use, would be a major public policy change. It would also come with significant risks because of no-fault insurance’s vulnerability to fraud and overall high costs.

3. Single Insurance Policy

In a 2017 publication entitled Pathway to Driverless Cars: Consultation on Proposals to Support Advanced Driver Assistance Systems and Automated Vehicles, Government Response, the U.K. government expressed concerns about the effect of automated vehicle product liability litigation on injured people.

The innocent victim of a collision involving an [automated vehicle] faces a number of issues, and would be at a disadvantage, in terms of securing quick compensation, compared to a victim of a collision involving a conventional vehicle for a number of reasons:

There would be no clear route to securing compensation, so they may have to take the vehicle maker to court, which could be time consuming and costly.

Innocent third party victims might not be covered for collisions as a result of the automated vehicle and/or software failure.

Drivers might not be covered in the event of the automated vehicle and/or software failure, so might not be insured when the [automated vehicle] is in control.

To address these concerns, the U.K. government passed the Automated and Electric Vehicles Bill, establishing a single insurance policy. The single insurance policy requires that insurers compensate people who are injured in collisions caused by automated vehicles, regardless of whether the human operator or automated technology was responsible. If the automated technology was the cause, after compensating the injured people, an insurer may try to recover any liability payments from the party responsible for the collision, such as the vehicle manufacturer or the technology provider.

The intent of the single insurance policy is to allow injured people to be compensated as they are now and to leave the product liability discussions to the insurer and the vehicle manufacturer or the technology provider.

“When a crash is determined to have been caused by an [automated vehicle], where the [automated driving function] was active, the insurer would be liable to pay compensation to the innocent third party victim. They would also pay out to the motorist if injured in the vehicle if the [automated driving function] were active…

“Where the manufacturer is found to be liable, the insurer will be able to recover against the manufacturer under existing common law and product liability laws. It is possible that some cases will go to court, though over time we expect insurers and manufacturers will develop processes to handle most recovery claims quickly and easily. And, in any case, we do not consider it to be in a manufacturer’s commercial interest to be unhelpful to insurers in determining liability or paying recovery claims; ultimately, insurers could potentially cease offering insurance products for the manufacturer’s vehicles if their route to recovery was consistently blocked.”

Source: Centre for Connected and Autonomous Vehicles. Pathway to Driverless Cars: Consultation on Proposals to Support Advanced Driver Assistance Systems and Automated Vehicles, Government Response. January 2017.

The single insurance policy facilitates liability claims for injured people by aligning the claims process for automated vehicles with the claims process for conventional vehicles. Unlike no-fault insurance, the single insurance policy can co-exist with the mixed no-fault and tort policies that are common in Canada. This co-existence is important because automated and conventional vehicles will share the roads in the years ahead.

By relying only on direct negotiations and the courts, the process where an insurer recovers liability payments from the vehicle manufacturer or technology provider could be protracted and costly. This process would benefit from a formal forum to quickly resolve any disputes that arise.

A Recommended Canadian Insurance Framework for Automated Vehicles

People who use automated vehicles will expect appropriate auto insurance and supporting legislation to be in place so that claims are fair and quick. For this reason, IBC developed an automated vehicles insurance framework for updating the auto insurance policies and supporting legislation to accommodate vehicles at SAE level 3, 4 and 5 automation.

The framework, which could co-exist with existing mixed no-fault and tort policies, consists of two components:

A single insurance policy that covers both driver negligence and the automated technology; and

A data-sharing arrangement with vehicle manufacturers, vehicle owners and/or insurers

Single Insurance Policy

A single insurance policy covering both driver negligence and the automated technology would ensure that vehicles continue to be properly insured and that people injured in collisions involving automated vehicles are compensated fairly and quickly. The single insurance policy’s intent is to align the tort process for automated vehicle claims with traditional claims involving conventional vehicles.

Insurance Coverage

With the single insurance policy, if the automated vehicle caused the collision, regardless of whether the driver or automated technology is responsible, an injured person would pursue a claim directly against the automated vehicle’s insurer. If the automated technology caused the collision, the insurer would compensate anyone injured, including the person in the driver’s seat of the automated vehicle. After compensating the injured people, the insurer would have a right to recover liability payments from the party responsible for the collision, such as the vehicle manufacturer or the technology provider.

The single insurance policy would also compensate people injured in a collision caused by a cyber breach of the vehicle’s automated technology. The insurer could then attempt to recover any liability payments from the party responsible.

While covering automated technology malfunctions and cyber breaches, the single insurance policy would pay only up to the minimum legislated amount for a collision that was caused by the vehicle owner and/or operator circumventing, modifying or failing to maintain safety-critical software. Software updates are considered safety-critical if it would be unsafe to operate the vehicle without installing them.

Despite access to the single insurance policy, an injured person could still pursue a claim directly against the vehicle manufacturer or technology provider. A person with a claim valued at more than the single insurance policy’s liability limits may prefer this option. In this case, the claim would proceed according to standard tort rules.

Liability Payments Recovery

Upon making a liability payment, the automated vehicle’s insurer would be able to recover from the vehicle manufacturer or the technology provider the part of the payment that was associated with the automated technology malfunctioning. The amount that the vehicle’s insurer could recover would be reduced by a monetary deductible.

The deductible, which would reduce the number of times insurers recover liability payments associated with the automated technology malfunctioning, would apply to a given event that causes a claim or claims, instead of just an individual claim. For instance, in addition to being able to recover payments for an individual collision with a claim that is valued higher than the deductible, an insurer could recover liability payments associated with a cyber breach that affects multiple vehicles where each individual collision results in an individual claim below the deductible but the aggregated cost of these claims surpasses the deductible.

The insurer, vehicle manufacturer and technology provider would have access to a mandatory binding arbitration process to settle any disputes. This arbitration process would involve specialized adjudication, which would be more efficient at resolving disputes than the civil courts. A party could appeal to the courts only on a matter of law.

Data-Sharing Arrangement

By working together after a collision, vehicle manufacturers and insurers can help their customers and anyone who was injured get compensated fairly and quickly. The data-sharing arrangement would consist of vehicle manufacturers making prescribed data available to vehicle owners and/or insurers to help determine the cause of a collision, whether the vehicle was in manual or automated mode at the time of the collision and the vehicle operator’s interaction with the automated technology. A data-sharing arrangement is crucial to a quick resolution of liability claims.

The process for sharing the data should be streamlined to facilitate the data transfer and avoid any administrative burden on vehicle manufacturers, vehicle owners or insurers.

California Data Recording Requirements

In California, as part of the permit to deploy automated vehicles on public roads that is prescribed in state regulation, Article 3.8 – Deployment of Autonomous Vehicles, vehicle manufacturers have to certify that their vehicles are equipped with an automated technology data recorder that captures and stores sensor data for all vehicle functions controlled by the automated technology at least 30 seconds before a collision. The data captured and stored has to be in read-only format and capable of being accessed by a commercially available tool.

Data elements that comprise IBC’s recommended data-sharing arrangement

GPS-event time stamp

GPS-event location

Automated status – on or off

Automated mode – parking or driving

Automated transition time stamp

Record of driver intervention of steering or braking, throttle or indicator

Time since last driver interaction

Driver seat occupancy

Driver belt latch

Speed

Vehicle warnings or notifications to the vehicle’s operator.

Recommended Federal Vehicle Safety Standards

Automated technology warrants standards under the Motor Vehicle Safety Act that are similar to those for tires, brakes, and emissions and restraint systems. These standards would provide a degree of confidence in the vehicles’ performance and safety.

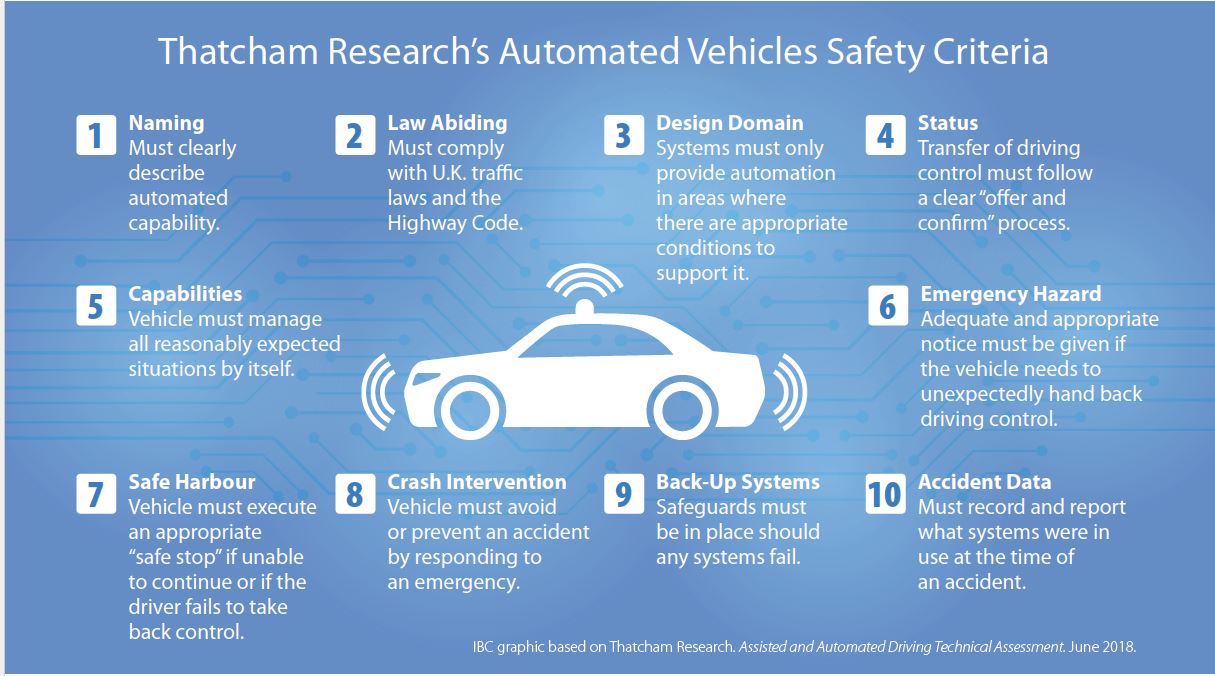

Thatcham Research recently published Assisted and Automated Driving Technical Assessment, which contains vehicle safety criteria for automated vehicles. The criteria indicate how automated vehicles should perform in certain driving conditions.

The U.S. National Highway Traffic Safety Administration released voluntary guidance for the development and rollout of automated vehicles. The Voluntary Guidance for Automated Driving Systems comprises 12 priority safety design elements for consideration, including vehicle cyber security, human-machine interface, collision-data recording, crash-worthiness, consumer education and training, and post-collision automated technology behaviour.

The U.S. National Highway Traffic Safety Administration released voluntary guidance for the development and rollout of automated vehicles. The Voluntary Guidance for Automated Driving Systems comprises 12 priority safety design elements for consideration, including vehicle cyber security, human-machine interface, collision-data recording, crash-worthiness, consumer education and training, and post-collision automated technology behaviour.

Both Thatcham Research’s automated vehicles safety criteria and the U.S. voluntary guidance provide important direction for the Canadian federal government as it considers automated vehicle technology and cyber security standards.

Conclusion

From improving road safety and potentially saving thousands of lives annually, to enhancing mobility and reducing traffic congestion, automated vehicles could change transportation systems around the world. The technology is evolving rapidly. With rapid change, comes risk.

Canadians who use automated vehicles, whether they use the vehicles for personal or business purposes, will expect appropriate insurance to be available. If involved in a collision, they will expect fair and quick compensation. Canadians will also expect the automated vehicles that they use to be safe and meet the highest standards for technology and cyber security.

Provincial and federal governments and regulators, insurers and other stakeholders must work together to put in place appropriate auto insurance policies and supporting legislation as well as updated vehicle safety standards. With automated vehicles coming to Canada’s roads in the near future, the time to begin this work is now.

来源:IBC 2018-11-15

0

元